We are all pretty stressed now, aren't we? We don't know how long will this COVID-19 caused lock down will last. Even when the lock down is lifted, surely the economy will go under recession. It will take sometime to speed up to normal level of consumption. Sitting where I am now, everything looks bleak. And the uncertainty is the real bummer! We don't know if this would last for 3 months or 1 year.

But if you look from a more objective long term perspective, the world operates in cycles. Period of booming growths have seeds for recession in them, and period of recessions have seeds of coming growth.

For example, in boom time, the economy is doing good and banks start lending more leniently thinking that good times would continue. This leads to increasing NPAs and when the music stops, the house falls down like a pack of card.

On the other hand, periods of recessions, makes the financial systems lean. Bloat is reduced, businesses become more efficient. Extra employees are laid off. Businesses become more capital efficient and hence, show increased growth few years down the line and voila, economic growth returns!

So, if you think carefully - Booms are not entirely bad nor busts are entirely bad. It is like the Yin Yang figure above. One is intertwined with other. Also, if you observe carefully - the Yang has a sliver of Yin in it, and vice versa.

This is a pattern which is not specific to economies, but is consistent across many human systems. Amish Tripathi famously talks about masculine and feminine way of life. If you check his Siva triology, he clearly distinguishes between two types of govt.

The “masculine" way hinges around a strong leader who assumes all responsibility for society. There is clear direction and purpose for society as a whole.

The “feminine" way is a loose democracy, with the leaders asking their followers for solutions, or letting them go by their own decisions. Questioning, debates, arguments and analysis form the basis of governance decisions, and creativity—however unconventional—is encouraged

And there is no right or wrong way. Both these elements need to be in balance for the society to function properly. But it seldom happens. At any one point of time, one element is dominant. When masculine element is dominant, the creativity in society reduces. Discipline increases. But soon discipline leads to militarism - which people find excessive and somebody revolts to bring back the feminine elements. More participative and accomodating democracy.

I guess, then the only question is - why don't we keep these two elements in balance? Why is it that one element takes over and we realise that we had moved too far when things go out of hand? Why don't banks controls NPAs in boom time.

Well, the only answer I can think of is that humans are short term thinkers. When going gets good we fil to recognise, that things will not always be good and indulge in excesses. Similarly, when things get bad, we loose hope that things will get good again and we over react. Since, this pattern repeats in almost all complex systems involving humans - I would argue that this is a feature of human beings which interact in the system, rather than the specific systems in question.

Ray Dalio explains how economic cycles work in this beautiful video. You must give it a watch. As you can see economy also moves in a cycle.

How the Economic Machine works by Ray Dalio

How the Economic Machine works by Ray Dalio

It was a candid discussion with both founders talking about their experiences and how they have survived nuclear winters ( not the literal ones 😜 but winters in business activity & funding)

It was a candid discussion with both founders talking about their experiences and how they have survived nuclear winters ( not the literal ones 😜 but winters in business activity & funding) What's your product positioning story? Would love to hear.

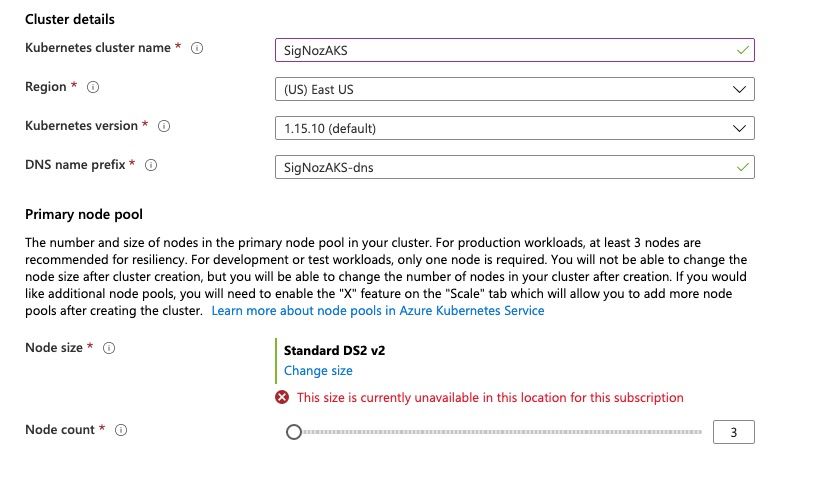

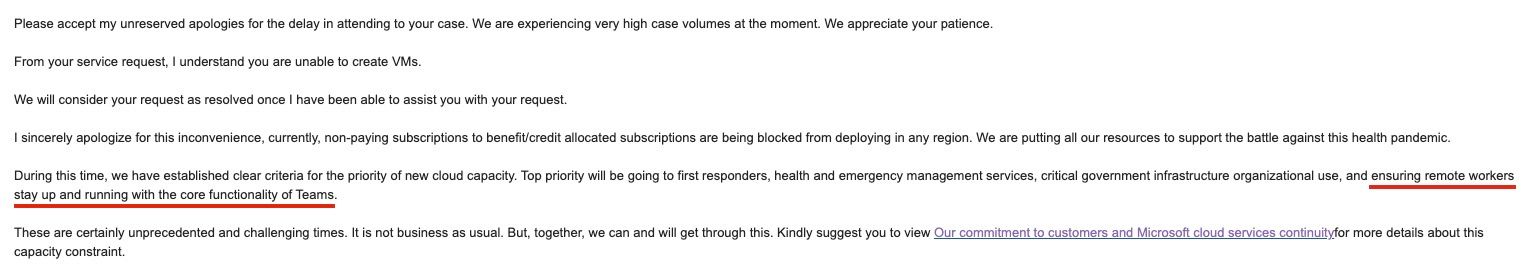

What's your product positioning story? Would love to hear. I thought that there was something wrong with my subscription, and hence reached out to customer support. The reply I got was very interesting.

I thought that there was something wrong with my subscription, and hence reached out to customer support. The reply I got was very interesting.

There was nothing wrong with my subscription or account. It was just that I was using free Azure credits for my account and Azure was just not allowing free credit users to create VMs.

There was nothing wrong with my subscription or account. It was just that I was using free Azure credits for my account and Azure was just not allowing free credit users to create VMs. Scene from Episode 3, Westworld Season 3

Greg Egan deals with the idea of simulated reality extensively in his book

Scene from Episode 3, Westworld Season 3

Greg Egan deals with the idea of simulated reality extensively in his book  Currently, I am doing 16-8. Eating only from 12 noon to 8pm with two meals and one light snack in the evening. I have lost 0.7 kg in last 3 days. Will keep you posted how it goes.

Currently, I am doing 16-8. Eating only from 12 noon to 8pm with two meals and one light snack in the evening. I have lost 0.7 kg in last 3 days. Will keep you posted how it goes.