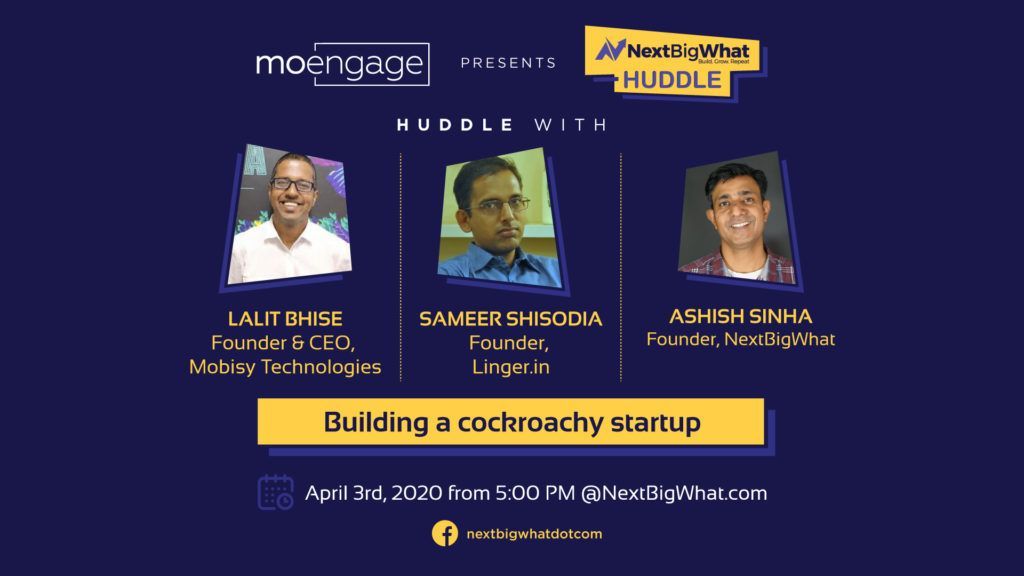

I attended a webinar today organized by Ashish from NextBigWhat. It was attended by Lalit from Mobisy and Sameer from Linger.

It was a candid discussion with both founders talking about their experiences and how they have survived nuclear winters ( not the literal ones 😜 but winters in business activity & funding)

It was a candid discussion with both founders talking about their experiences and how they have survived nuclear winters ( not the literal ones 😜 but winters in business activity & funding)

Here are some of my jottings:

- Don't think of yourself as a startup. Think of yourself as a business. A "dhandha" business. And the first objective of any business is to survive. You can do anything, have any impact, only if you survive.

- You have to create value. Value for which somebody is willing to pay you. Customer paying you hard money is the best indicator of you having generated value for him. Focus on that.

- If you are an early stage startup, and trying to figure out if you are making anything of value - start charging money. Freemium is not a good strategy for early stages as you are just delaying the moment of truth - when he shows you the greenback 💵

- In good times you tend to bloat. So period of harships, though undesirable, are good to become lean. As a business, you should always try to be lean. This applies even if you are an early stage startup business or a 1000 people company.

- VC money is a fertiliser. As a founder you have to be aware what kind of plant are you? Are you a grass 🌿, slow growing tree 🌲 or a fast growing tree 🌳. VC money is only helpful if you are a fast growing tree. As VCs have a time frame for which they invest and they would come asking for the timber once you are due. So, be self aware. What kind of business are you building? What type of business suits you (as a founder) and the market you are targeting?

- Taking VC money is like buying a ticket to the bus ride. Once you have bought the ticket, you need to finish the ride 🚌 You need to take the business to a logical conclusion in the VC fund time fram ( ~6-8 years) You either become big, bet acquired or bring in bigger investors to gives exit to the early stage VC. Or you shut down.

- Founders and VCs operate at a very different timelines. Any VC has a fixed time period in which they need to return the fund (~6-8 yrs). They need to invest, see growth in the startup and exit in this time period. Founders potentially would like to run their company for their lifetime. It's easy for them to think in decades.

- The risk profile of VCs is very different than the founders. They have a portfolio of companies and they need 1-2 companies to become a blockbuster to return the fund. So they want you to go big or go home. But founders have a portfolio of 1

- With the compulsory lockdown in many places currently, customers are more amenable to video calls. They are finding that video calls are more productive as there are less transition costs. Sales people are also booking 2X meetings, at least for Lalit's business. His belief that people will realise the value of video meetings and it will become more important even post-lockdown.

- Now is a good time to build teams. There is lot of talent available in the market now and you could potentially have some very good people join your team - which would be not available in better times.

Every challenge is also an opportunity. It all depends on what you make of it.