Well this is not a headline which I came up with myself. This is the title of a chapter in Friedrich Hayek's book The Road to Serfdom, but I think its very relevant to the world we live in today.

I used to always question why in many domains, especially politics & governance the worst come out on the top. When many of us (at least in my friend circle) agreed that a particular candidate was absolute crass - why does he rise to power? Why don't more educated and intellectual people rose to power and took the nation/state to better place? To me this seemed very perplexing.

Little did I know that a mind far better than mine had debated this in his book written in 1944. If you haven't read about Hayek, you must check him out. Currently he is one of my top 5 authors, right along with Dostoevsky, Nietzsche, Neil Stephenson & Ayn Rand.

I will not try to reinvent the wheel here, but just summarize the arguments made by Hayek in simple words. He argues that in a totalitarian system, the rise of "worst" people to the top is by design. You have to understand that this is a period when Hitler is still in power and World War II is ongoing.

- Not all good people necessarily wish to have a share in the government. They would rather entrust it to somebody whom they think more competent.

- Totalitarianism is a powerful system alike for good & evil, and the purpose for which it will be used depends entirely on the dictators.

- Totalitarian govts. generally come about because of slow & cumbersome course of democratic procedures.

- In such situation, the man or the party who seems strong enough "to get things done are elected.

- To get a party/man elected - they don't need support of huge numbers at occasional elections, but in the absolute & unreserved support of a smaller but more thoroughly organise body.

- Socialism can be put into practice only by methods which most socialists disapprove of. The old socialist parties were inhibited by their democratic ideal, they didn't possess the ruthlessness to carry out their chosen task.

- In a planned society, the question is not what do a majority of of the people agree on but what the largest single group is whose members agree sufficiently to make unified direction of all affairs possible

- There are 3 main reasons why such a numerous and strong group with fairly homogenous views is not likely to be formed by the best but by the worst elements of any society

- The higher the education and intelligence of individuals become, the more their views and tastes are differentiated and the less likely they are to agree on a particular hierarchy of values. This doesn't mean that majority of people have low moral standards, it merely means that the largest group of people whose vaues are very similar are the people with low standards.

- A dicatator or strongmen would be able to obtain the support of all docile and gullible, who have no strong convictions of their own but are prepared to accept a readymade system of values if it is drummed into their ears sufficiently loudly and frequently.

- It is a law of human nature that it is easier for people to agree on a negative program - on the hatred of an enemy, on the envy of those better off - than on any positive task

From a totalitarian point of view, intolerance and brutal suppression of dissent, the complete disregard for life and happiness of the individual, are essential consequences of the premise that the state comes first, and individuals must keep the interest of the collective/state first, over their own.

To help in running a totalitarian state, a man must prepare to actively break any moral rule he has ever known if this seems necessary to forward the collective goal.

And since, it is the supreme leader who alone determines the ends, his instruments must have no moral convictions of their own.

Thus it is evident that, any leader which rises to the top of a totalitarian regime, he must not have any moral values of his own, which can't be broken. He should be able to engage in a negative program to rally the troops against a common enemy and be willing to convince all those gullible & docile with arguments which don't come under the purview of true or false. The only criteria they must satisfy is that they should forward the goal of the totalitarian state.

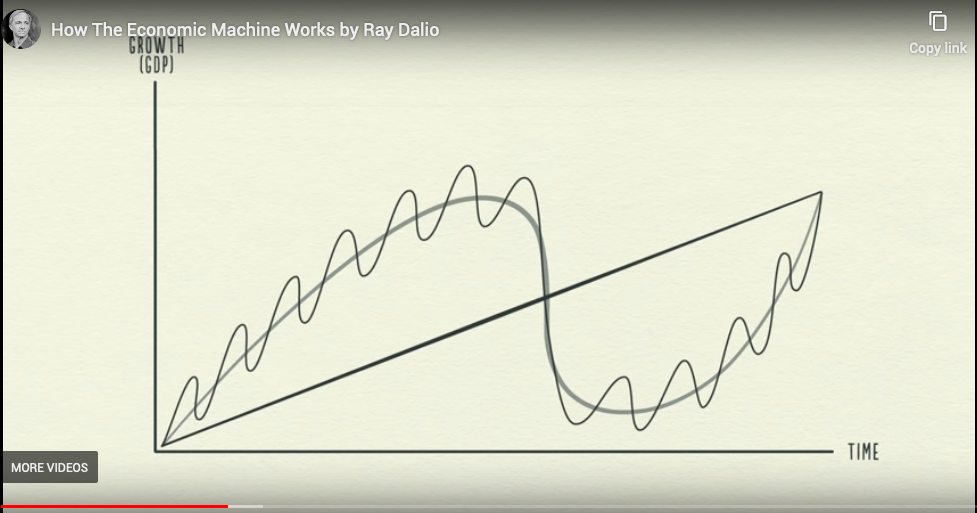

How the Economic Machine works by Ray Dalio

How the Economic Machine works by Ray Dalio It was a candid discussion with both founders talking about their experiences and how they have survived nuclear winters ( not the literal ones 😜 but winters in business activity & funding)

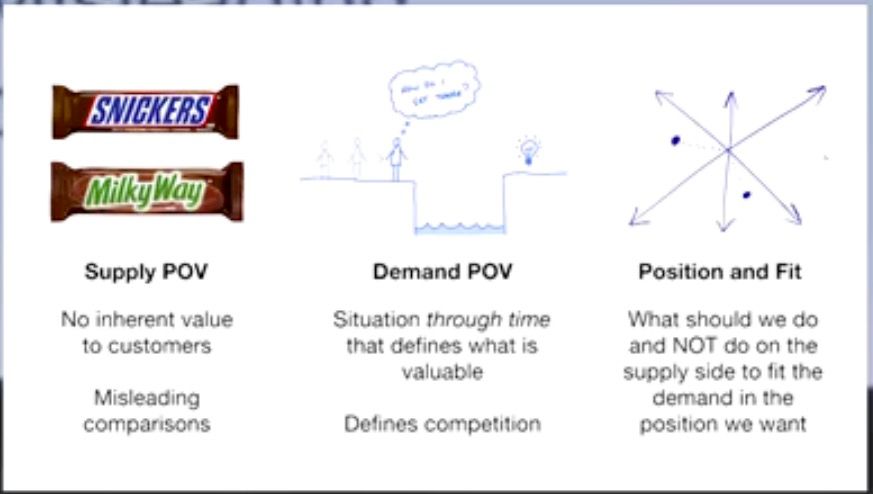

It was a candid discussion with both founders talking about their experiences and how they have survived nuclear winters ( not the literal ones 😜 but winters in business activity & funding) What's your product positioning story? Would love to hear.

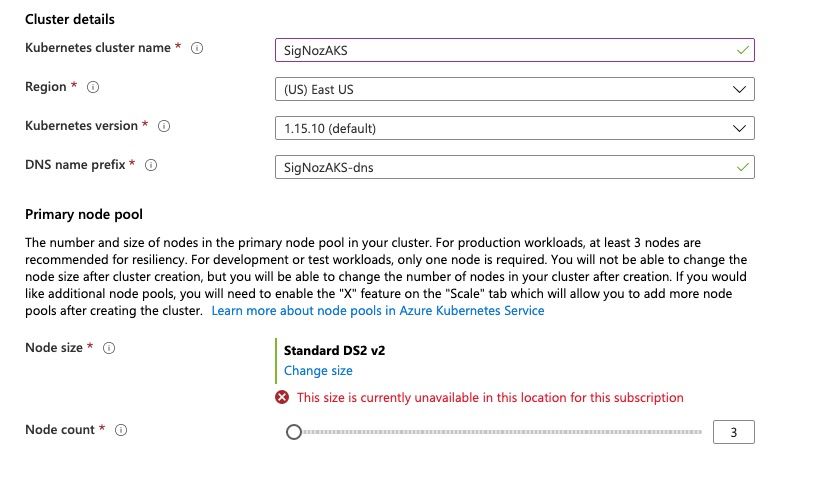

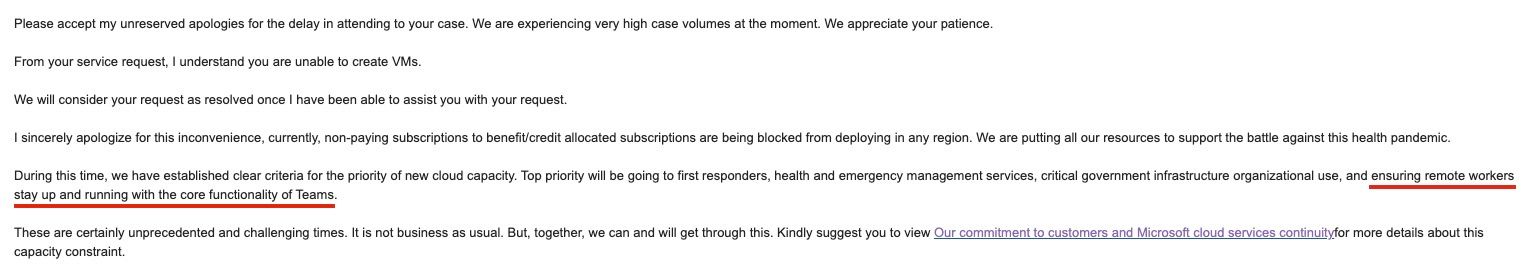

What's your product positioning story? Would love to hear. I thought that there was something wrong with my subscription, and hence reached out to customer support. The reply I got was very interesting.

I thought that there was something wrong with my subscription, and hence reached out to customer support. The reply I got was very interesting.

There was nothing wrong with my subscription or account. It was just that I was using free Azure credits for my account and Azure was just not allowing free credit users to create VMs.

There was nothing wrong with my subscription or account. It was just that I was using free Azure credits for my account and Azure was just not allowing free credit users to create VMs. Scene from Episode 3, Westworld Season 3

Greg Egan deals with the idea of simulated reality extensively in his book

Scene from Episode 3, Westworld Season 3

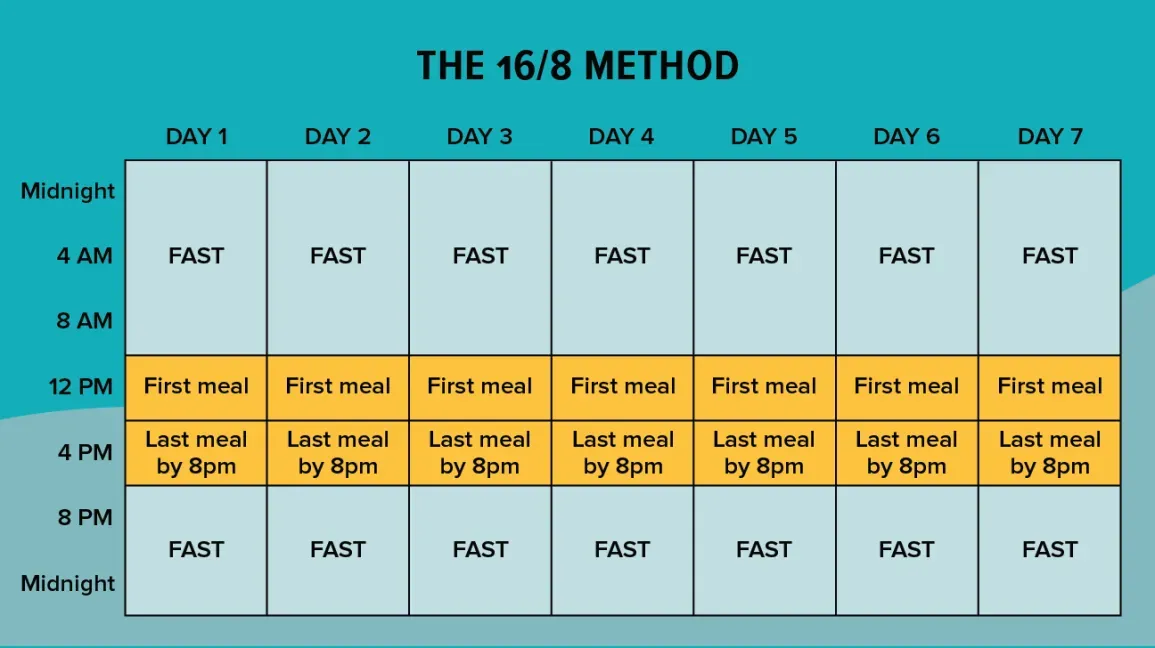

Greg Egan deals with the idea of simulated reality extensively in his book  Currently, I am doing 16-8. Eating only from 12 noon to 8pm with two meals and one light snack in the evening. I have lost 0.7 kg in last 3 days. Will keep you posted how it goes.

Currently, I am doing 16-8. Eating only from 12 noon to 8pm with two meals and one light snack in the evening. I have lost 0.7 kg in last 3 days. Will keep you posted how it goes.